The RBF meaning is different than you think

by Cydney Green

In today's financial landscape, the term "RBF" transcends its colloquial interpretation as "resting bitch face" to embody a pivotal concept: revenue-based financing. The financial RBF meaning is rather significant, albeit it's humorous roots. This innovative funding model, championed by industry leaders like Ratio Tech, offers a transformative approach to business growth, steering away from the pitfalls of equity dilution and loss of control. By delving deeper into the multifaceted realm of revenue-based financing, businesses gain insights into its strategic significance and its symbiotic relationship with emerging trends like BNPL (Buy Now, Pay Later) for B2B transactions.

RBF: An Evolution in Financing Strategies

At its core, revenue-based financing (RBF) represents a paradigm shift in funding mechanisms, enabling companies to secure capital in exchange for a percentage of their ongoing revenue. This departure from traditional loans or equity financing models is particularly advantageous for SaaS startups and businesses with predictable revenue streams, as it empowers them to fuel expansion efforts without relinquishing ownership or control.

The Partnership of Revenue Based Financing and BNPL for B2B Transactions

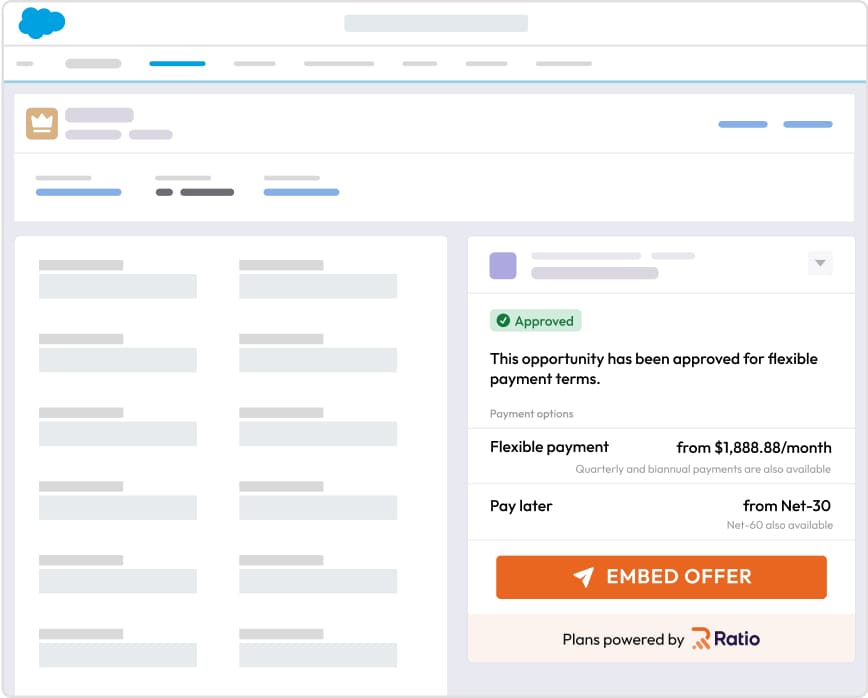

As businesses navigate the dynamic landscape of modern finance, the integration of BNPL schemes into B2B transactions emerges as a groundbreaking trend. This model democratizes flexible payment options, extending the convenience of BNPL to the realm of business transactions. Ratio Tech, a pioneering force in this evolution, offers tailored financing solutions that empower clients to defer payments or split them into manageable installments, all while accessing immediate funding opportunities.

Case Studies in Innovation and Growth

Leaders in various sectors, such as Nohtal Partansky of Sorting Robotics and Oz Eleonora of Bitivore, attest to the strategic advantages of revenue-based financing. Partansky emphasizes Ratio Tech's role in facilitating the transition to Robotics-as-a-service, highlighting the benefits of customer payment flexibility and enhanced enterprise value. Eleonora underscores the importance of liquidity for growth, crediting Ratio Tech with enabling Bitivore to optimize cash flow and maintain control over its destiny.

Nohtal states, “As a software company, liquidity is paramount to fueling our growth. But raising capital can be expensive, dilutive and with unpredictable timing. With Ratio, we are able to leverage our recurring revenues to optimize cash flow and fuel our growth, without dilution – all through a process that is accretive to sales conversion and puts us in control of our own destiny.”

Selecting the Right Partner for Growth

The success of revenue-based financing initiatives hinges on selecting the right partner. Ratio Tech distinguishes itself as a leading provider, offering solutions tailored to the unique needs of diverse industries. By collaborating with Ratio Tech, businesses can ensure that their financing strategy aligns with their growth objectives, market dynamics, and customer needs, setting the stage for sustainable expansion and innovation.

Empowering Strategic Growth and Operational Flexibility

The integration of revenue-based financing into a company's financial strategy fosters unparalleled growth and operational agility. It enables aggressive investment in marketing, product development, and market expansion, with repayment obligations aligning flexibly with revenue performance. This model safeguards founder ownership and opens avenues for future funding rounds without significant equity dilution.

In Closing: Redefining RBF Beyond the Acronym

As businesses embrace the transformative potential of revenue-based financing, the true essence of the RBF meaning emerges as a beacon of financial opportunity and strategic empowerment. With Ratio Tech as a guiding partner, companies navigate the complexities of modern financing, embracing growth and innovation with confidence and clarity.

By demystifying revenue-based financing and showcasing its synergistic potential with BNPL for B2B transactions, businesses set the stage for a new era of economic innovation and growth. In the ever-evolving landscape of finance, RBF isn't just redefining business—it's shaping the future of commerce.

In today's financial landscape, the term "RBF" transcends its colloquial interpretation as "resting bitch face" to embody a pivotal concept: revenue-based financing. The financial RBF meaning is rather significant, albeit it's humorous roots. This innovative funding model, championed by industry leaders like Ratio Tech, offers a transformative approach to business growth, steering away from the pitfalls of…

Recent Posts

- Leading the Charge in Louisville’s Junk Removal and Demolition Services

- Exploring the Drawbacks of Duct Cleaning: Insights from Air Vent Cleaning Charlotte

- Exploring the Drawbacks of Duct Cleaning: Insights from Air Vent Cleaning Charlotte

- Clearing the Dust: Duct Cleaning Louisville KY Shares Tips to Make Your Home Less Dusty

- Landscaping Corpus Christi: Your One-Stop Solution for Superior Landscape Design and Lawn Care Services